IRS Mileage Log Requirements

Depending on your situation, you may need to comply with different legal or other IRS mileage log requirements to maintain compliant records.

Your employer may have specific mileage reporting requirements, and the IRS also has rules , which apply to business owners and the self-employed.

Reading: How to create a mileage log

In this article we look at mileage reporting from both an employee and self-employed perspective.

Ask yourself whether you are keeping your logbook correctly have? With Driversnote as your odometer, your trips are automatically logged in the way the IRS desires.

The IRS defines appropriate records for your mileage log

Regardless of your employment circumstances, you probably will requested to record:

- mileage for each business use

- total mileage for the year

- time (date will suffice), location (your destination) and business purpose of each trip

- Mileage readings at the beginning and end of the year

You can learn more about the IRS mileage log requirements (scroll for Example to Table 5.2) when it comes to business mileage logging.

It is also required that the mileage logs are available in a timely manner. This means that you must log the mileage at the time of the trip or just before the trip – anything updated weekly will be considered sufficient.

See also: How to Start a Podcast on YouTube in 7 Steps [2023 Guide]

If you are self-employed or a business owner you must comply the IRS definition of reasonable records. Remember, the rules cover all transportation-related expenses.

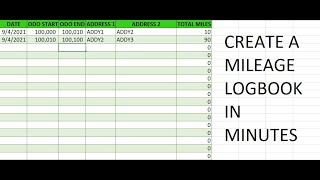

Mileage log formats accepted by the IRS

Paper, journal, ledger, digital spreadsheets, CSV files, PDF files, Xlsx (Microsoft Excel) are all accepted by the IRS. In other words, the format doesn’t matter as long as the correct records are in place (see “Adequate Records” above).

The IRS provides a paper template for mileage logging, but manual trip logging is now widely considered an obsolete way of keeping records.

As an employee, your employer should let you know what records they need and what logbook formats they can handle.

Does the IRS require odometer readings?

It’s a myth that the IRS requires you to record your odometer at the beginning and end of your trip.

There is currently no law requiring you to do so Record mileage except at the beginning and end of each year and when using a new vehicle.

However, keep in mind that your employer may ask you Record mileage more frequently.

IRS Mileage Tracking Requirements

See also: How to Create AdSense Account for Blogger (Step-By-Step)

There are no requirements for how you track your mileage other than that you record the mileage of each trip. This means either

- recording the odometer at the start and end of the ride, or

- tracking/recording your rides in some other way, for example with a GPS device or a mileage tracking mobile application.

The easiest way to meet IRS mileage tracking requirements is to use a mileage tracking app. There are a number of apps designed to make it easy to track and record your mileage in a compliant manner such as: B. Drivers Note. Driversnote works for iOS and Android and for both self-employed and employees.

Does the IRS require that I also record personal mileage?

If you register your vehicle(s). ) for both business and private purposes, you must be able to prove the business part of the use. You calculate this as a percentage of miles driven for both business and personal use. That means logging all trips and then calculating the business portion.

Keep copies of logbooks as an employee

As an employee, you may be asked to provide evidence of your trips as an expense to the IRS (which may include mileage allowance for various reasons) across the board. This can happen through no fault of your own, so it’s generally a good idea to keep copies.

Using a digital odometer increases the likelihood that you’ll have adequate records when you need them. The Driversnote app is an example of a compliant mileage log and tracker that allows you to have all your records in one place and generate a report at any time.

When you are audited

If you are audited, the IRS may request logbooks, which will be accepted in any of the formats above.

To speed up the process and avoid errors, you should order your logbooks and records at least per year. It’s a good idea to log your trips at least once a week to ensure you don’t miss a refund.

See also: How to Create an HTML Form That Sends You an Email

FAQ

.