How To Sell an Online Business: The Complete Guide

The Guide to Selling an Online Business on Flippa

Why Sell an Online Business?

In this detailed guide you will discover how Sell your online business (e.g. websites, domains, apps, e-commerce store) on Flippa for a profit.

Reading: How to create a flippa website sales listing

It may seem like a daunting task, but it’s really easy.

There are two questions we need to answer here:

Why are you selling your online business? and why sell it on Flippa?

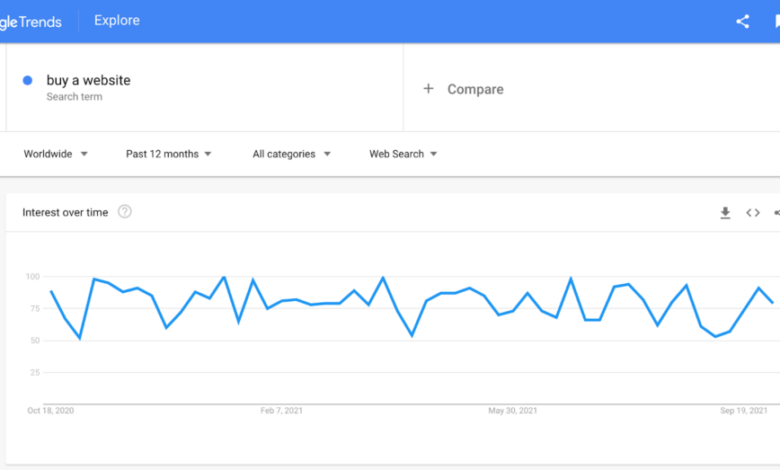

To give you a clearer picture, the demand for online businesses has gone through the roof today. If you take a look at the Google trending data for “buy website” over the last 12 months, you can see that the demand has been pretty consistent:

Digital real estate are gaining in importance every day – especially at this time when companies and economies have become increasingly dependent on the Internet.

If you have a digital asset, you may be thinking: Should I sell the company or continue with it ? ? This concern is common, especially among people who have been buying and selling brick and mortar businesses for ages.

A large lump sum payout could be a good reason to sell your business. For some, selling their online business means working less, venturing into new projects, or using it as a mechanism to pay off debt (eg, student loans, a home loan) and gain financial independence.

Perhaps you would be happier with a payout equal to a few years’ income or even more. That way you can (probably) retire or take a sabbatical and spend quality time doing what you love.

Others just want to focus on another project and another profitable one Build a business without withdrawing the time it takes to run it.

There are many reasons for selling an online business. I remember selling my business to invest in real estate while my friend sold his business to buy a car. A physical purchase can require a lot of money that can take years to accumulate through traditional savings.

Need money for your kids’ college tuition? Do you want to support your parents with their retirement?

All of these and more could be the reason you are so excited to sell your online business.

As an entrepreneur, you agree that starting a business can be exciting – while managing the day-to-day tasks can get tedious.

See also: How to сreate a logo in Gimp: step-by-step guide & video tutorials

When it comes down to it, your business may also have outgrown your capabilities, and you’re deciding whether to sell it Business with someone else with the required skills is better for everyone. You can access the capital and freedom you are looking for, and you will hand your business over to a new owner who is dedicated to running the business.

The decision to sell your business is associated with mixed feelings. We’re here to guide you through the process of selling your online business – so you can get the most out of it.

Why should you sell your business on Flippa?

Flippa is not only the original platform for buying and selling online businesses, but also the largest and most reliable platform for selling your online business. In the last ten years, Flippa has generated the most sales (over $400 million), attracted thousands of loyal buyers and created an easy-to-use platform (even for beginners).

With well over 1.5 million active users Flippa attracts around 5,500 new users every month. This has resulted in over 10 million searches every month. Flippa also has an active user base that is constantly engaging with the site, checking for new listings and starting meaningful discussions between buyers and sellers.

You will soon find that Flippa is selling and buying online businesses simple and user-friendly makes -friendly.

1. Flippa is a peer-to-peer platform

Flippa is a peer-to-peer platform – unlike other marketplace platforms, you don’t have to hide behind brokers or other service providers when you don’t want that. You can create your listing and provide as much detail as possible.

You can chat directly through the Flippa platform and easily answer questions from buyers. And most importantly, you can determine the price you are willing to accept for your business. You are in full control and it’s a great place to finalize a buy and sell agreement, pre-qualify buyers, sign a purchase agreement, enter into a non-disclosure agreement and more.

2. Flippa allows you to negotiate with potential buyers

Another key factor that makes Flippa stand out. Yes, you can negotiate with potential buyers.We encourage it!

You’ve spent the time building a ready-to-sell business, so it’s entirely up to you what you’d like to sell it for. Flippa simply supports you along the way by providing reviews information, exposing your business to the widest possible range of atractable buyers, and facilitating conversations between buyers and sellers.

3. Flippa offers secure transactions

Do you want secure and smooth transactions? Flippa is there for you. You can feel safe with Flippa’s service or Escrow knowing your transactions will be smooth and seamless.

Nothing is more important than ensuring secure transactions on any platform, especially when you are selling a business, that you sell. I worked so hard on it.

4. Flippa is an affordable marketplace

Flippa is an affordable service. Listing fees are low and success fees are the best on the market. While you might stumble across similar marketplaces that don’t charge a listing fee, they also don’t have the technology, security, and dedicated user base that Flippa brings to the table.

5. Flippa’s Broker Matching

When you register and list your business for sale on Flippa we offer two options; either “self-service” or “broker matching”. A broker might be the best option if you want extra help selling your business. Realtors review your appraisal, work with potential buyers, help prepare critical paperwork and field offers, and manage the DD process. Learn more about Flippa’s broker matching program here.

What is my deal worth?

Many sellers, particularly first time sellers, may not know where to start with identifying their business should start value. Flippa is the best place for anyone selling an online business.

As the largest and most established marketplace for buying and selling online businesses, we have the largest amount of sales data to give you an accurate estimate of the value of your business.

See also: How to Create a Business Email Address With a Custom Domain (4 Methods)

The Evaluating a restaurant or laundromat may seem easier with decades of data available to study and reference. That said, we’ve compiled 10 years of company sales data to make the assessment as easy as possible.

Remember, buyers are looking for opportunity, but they’re paying for performance. This is important when making decisions about the value of your business. Sellers often tell us, “My business is worth $XX because of the incredible growth opportunity.”

While that may be true, most buyers base a business’s value on past performance and proven earnings. Some other factors may play a role in your business valuation, such as:

- If a business has legal problems (e.g. a business partner, competitor, etc.).

- The type of business structure.

- A company’s credit history (e.g. commercial credit cards).

- Customer loyalty.

- Legal documents (e.g. non-competition clause, intellectual property, employee stock options, etc.).

- Financial modeling (e.g. the level of detail in financial records or the type of accounting principles a company uses – top-down accounting or bottom-up approach).

- Wealth management and how a company manages profits (e.g. what types of assets a company holds on its balance sheet).

- Variety of revenue channels (e.g. a company for HR software). can run on a SaaS model where customers pay a monthly fee to use a company’s software, but it can also support other revenue streams such as big data, affiliate commissions for referrals, company advertising options, etc.).

- Are there opportunities to increase sales?

You can also use Flippa’s online valuation tool to get an approximate value of your business, which can help you in your exit plan.

So what does it mean when we say buyers are looking for “opportunities” in an asset? You look at your page views, keyword rankings, social media followers, email subscribers, website age and the potential revenue that could be generated. But at the end of the day, buyers pay for performance.

So, let’s dig deeper and first look at how you want to value your annual income.

Seller’s Discretionary Income (SDE)

How is your company rated? To answer this critical question, let’s explain what performance looks like, and for Flippa, Seller Discretionary Earnings (SDE) is the best metric.

SDE gives a meaningful and realistic view of how your web store is performing in the last six months, one year or within a certain period of time. Past performance can be the benchmark for valuation and SDE provides an easy way to value a small business managed by one or two owners.

It also considers the points below, costs arising from the non-presentation.

The input tax, as well as the Pre-interest earnings before non-cash expenses show how much money your business makes annually.

Any one-time expenses can be removed from your expense list if you spend $25,000 to build your website or $5,000 If you had to pay for legal advice, you can remove this cost from the assessment as it will not have to be paid again – it is a one-time expense won by a new owner. Don’t worry.

Any unrelated business expenses can also be removed.For example, business meals, travel, car payments, health insurance, or other expenses don’t necessarily go to a new owner.

And finally, you want your Ge just let it flow back into profits as it is up to the new owner how much they pay themselves.

Assuming you had some one-time expenses and salary, your SDE should be higher on your P&L than your EBITDA.

What are the average sales multiples on Flippa?

Buyers look for opportunity, but they pay for performance.

See also: How to Design a Logo for Beginners (With a Free Worksheet!)

.